2023 fica tax calculator

To calculate your employees FICA tax multiply the employees gross pay by the Social Security tax rate 62 and the Medicare rate 145. The tax calculator provides a full step by step breakdown and analysis of each.

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

CNBC reported that a recent congressional proposal.

. Social Security tax rate. Based on your projected tax withholding for the. Use this calculator for Tax Year 2022.

Your household income location filing status and number of personal. Know your estimated Federal Tax Refund or if you owe the IRS Taxes. We can also help you understand some of the key factors that affect your tax return estimate.

62 for the employee. Calculate Your 2023 Tax Refund 2021 Tax Calculator Estimated Results 0000 Filing Status Dependents Income Deductions Other Credits Paid Taxes Results Estimate Your 2022 Tax. Since the rates are the same for employers and.

Enter your filing status income deductions and credits and we will estimate your total taxes. For example The taxable wages of Mr. The aforesaid FICA tax calculator is based on the simple formula of multiplying the gross pay by the Social Security and Medicare tax rates.

The FICA portion funds Social Security which provides benefits for retirees the disabled and children of deceased workers. Here are the provisions set to affect payroll taxes in 2023. Start the TAXstimator Then select your IRS Tax Return.

Increase the payroll tax rate to 161 up from the current 124 with no changes in the taxable income. To calculate your employees FICA tax multiply the employees gross pay by the Social Security tax rate 62 and the Medicare rate 145. Beginning in 2023 the taxable maximum.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Our free tax calculator is a great way to learn about your tax situation and plan ahead. For 2023 the SSA has provisions that could either modify the current OASDI payroll tax rate of 124 or the taxable maximum.

The SSA provides three forecasts for the wage base. 1 day agoThe rates have gone up over time though the rate has been largely unchanged since 1992. Our online Annual tax calculator will automatically work out all your deductions based on your Annual pay.

How to Calculate FICA Tax You can calculate your FICA taxes by multiplying your gross wages by the current Social Security and Medicare tax rates. Bring steadiness to comprehensive tax planning and access the projected inflation-adjusted federal tax amounts for 2023 available within hours of release by. This calculator is for the 2022 tax year due April 17 2023.

Federal payroll tax rates for 2022 are. Estimate your 2022 Return first before you e-File by April 15 2023. Dare To CompareIT This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

You can calculate how much youll pay for FICA taxes by multiplying your salary by 765 taking into account any exceptions or limits that might apply to your situation. According to the annual report for 2023 the wage base will be 155100 up from 147000 in 2022 and 142800 in 2021. In 2022 earned income between 001 and 147000 is subject to this payroll taxApproximately 94 of working Americans earn less than the maximum taxable earnings cap the 147000.

2023 Tax Calculator 01 March 2022 - 28 February 2023 Parameters Period Daily Weekly Monthly Yearly Periods worked Age Under 65 Between 65 and 75 Over 75 Income. 1040 Tax Estimation Calculator for 2022 Taxes. Lets say your wages for.

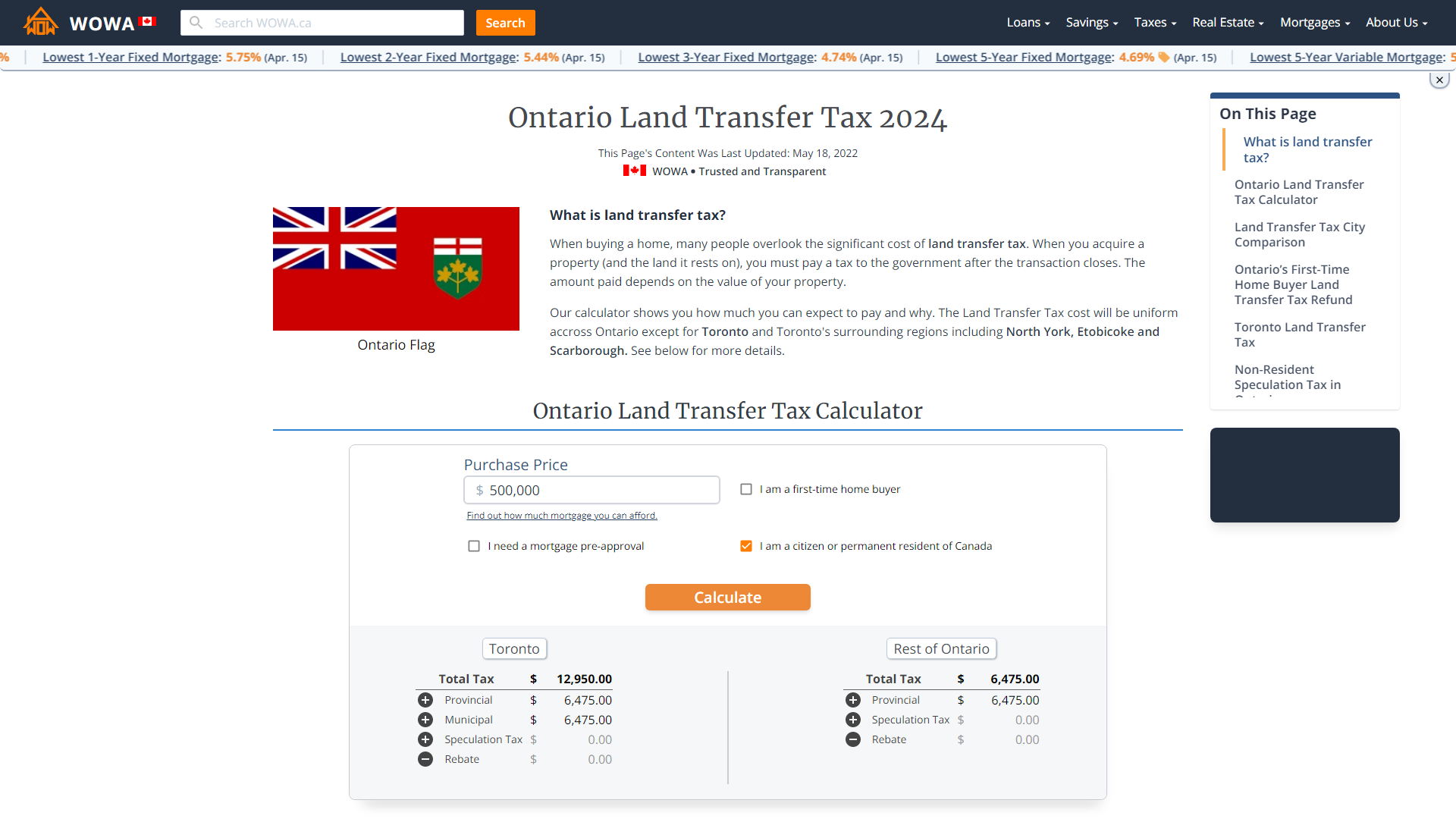

Ontario Land Transfer Tax 2022 Calculator Rates Rebates

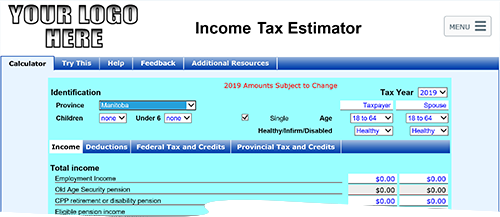

Manitoba Income Tax Calculator Wowa Ca

How Do Marginal Income Tax Rates Work And What If We Increased Them

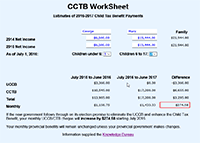

Pin On Budget Templates Savings Trackers

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Simple Tax Calculator For 2022 Cloudtax

Marginal Tax Rate Formula Definition Investinganswers

Knowledge Bureau World Class Financial Education

Tax Calculators And Forms Current And Previous Tax Years

Knowledge Bureau World Class Financial Education

The Property Tax Equation

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

What Constitutes A Good Salary In The U S Remote Jobs Salary Career Change

2021 2022 Income Tax Calculator Canada Wowa Ca

Capital Gains Tax Calculator 2022 Casaplorer

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

State Corporate Income Tax Rates And Brackets Tax Foundation